MQL5 Marketplace Link: https://www.mql5.com/golden-algo-ea

Cybermoon Product Purchase Link: https://cybermooncafe.com/product/golden-algo-ea/

Introduction

In the ever-evolving world of forex trading, automated solutions like the Golden Algo Forex Robot have gained significant traction among traders looking to maximize profits while minimizing the emotional aspects of trading. Today, I’m taking a deep dive into the Golden Algo Expert Advisor – a specialized forex robot designed specifically for gold (XAUUSD) trading.

What Makes the Golden Algo EA Forex Robot Different?

The forex robot market is saturated with solutions making bold claims, but the Golden Algo EA has some distinctive features that set it apart from many competitors. Unlike generic trading algorithms, this forex robot focuses exclusively on gold trading, leveraging specific patterns and behaviors unique to the XAUUSD pair.

Golden Algo combines three core elements in its trading approach:

- Technical indicators for precise entry and exit points

- Real-time market data including US Index movements and market sentiment

- AI-powered validation through OpenAI integration for signal confirmation

This multi-layered approach creates what the developers call a “market-adaptive logic” system that continuously adjusts to current trading conditions.

Key Features of the Golden Algo EA Trading System

Specialized Gold Trading Strategy

Unlike many forex robots that claim to work across multiple currency pairs, Golden Algo is specifically designed for gold trading. This specialization allows it to incorporate gold-specific market behaviors and correlations that generic algorithms might miss.

Risk Management Architecture

One aspect that caught my attention is the strict 3:1 risk-to-reward ratio the system employs. Every trade comes with clearly defined stop-loss and take-profit levels – a crucial feature for long-term sustainability. The system avoids dangerous practices like:

- Martingale strategies

- Grid trading

- Excessive position averaging

- Wide or floating stop losses

AI-Enhanced Trading Signals

The integration with OpenAI for signal validation represents an interesting innovation. According to the developers, each potential trade is filtered through an AI process that helps eliminate lower-probability setups, potentially increasing the overall win rate.

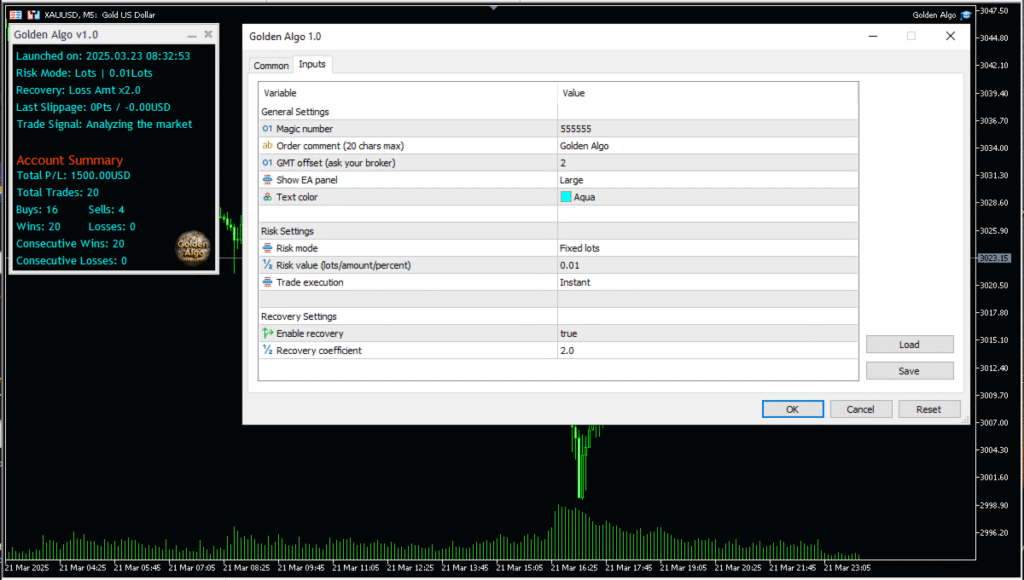

Recovery System Options

While the core strategy doesn’t use martingale approaches, the EA does include an optional recovery mode. This feature can multiply previous losses by a customizable coefficient to attempt recovery – though this can be completely disabled for those preferring a more conservative approach.

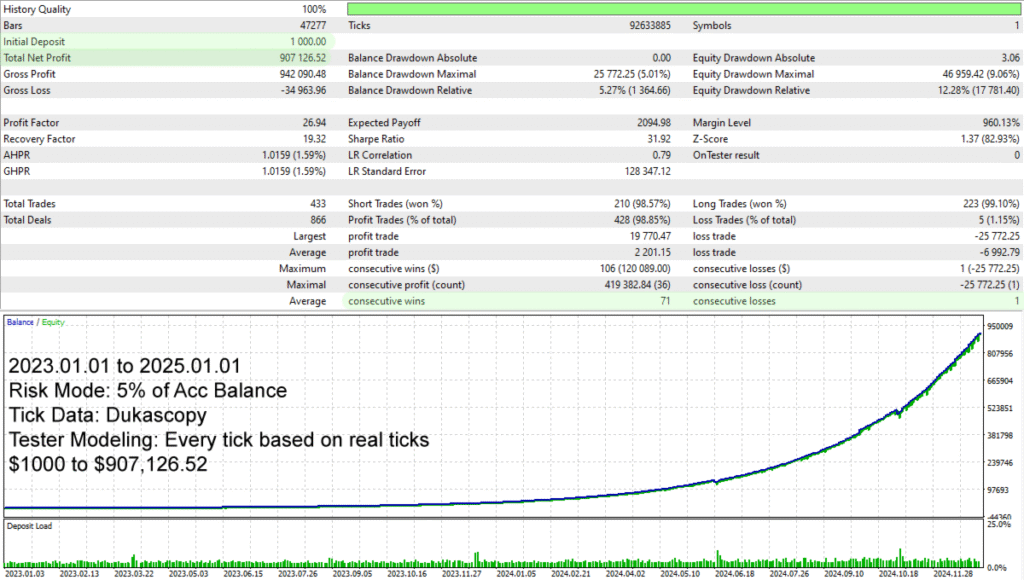

Golden Algo EA Performance Claims and Reality Check

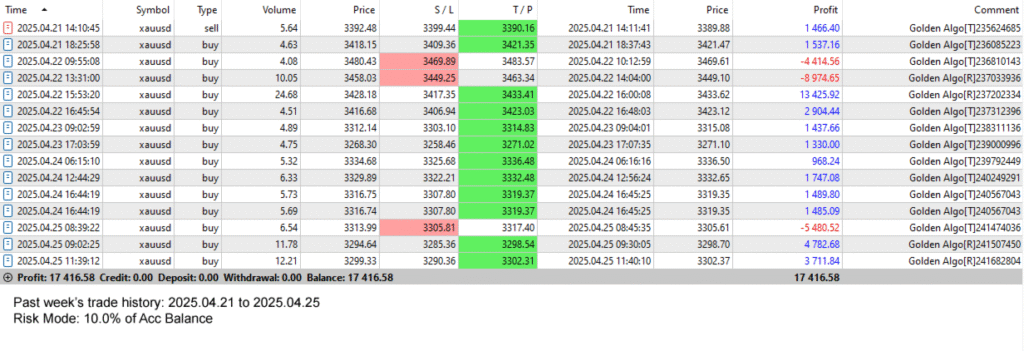

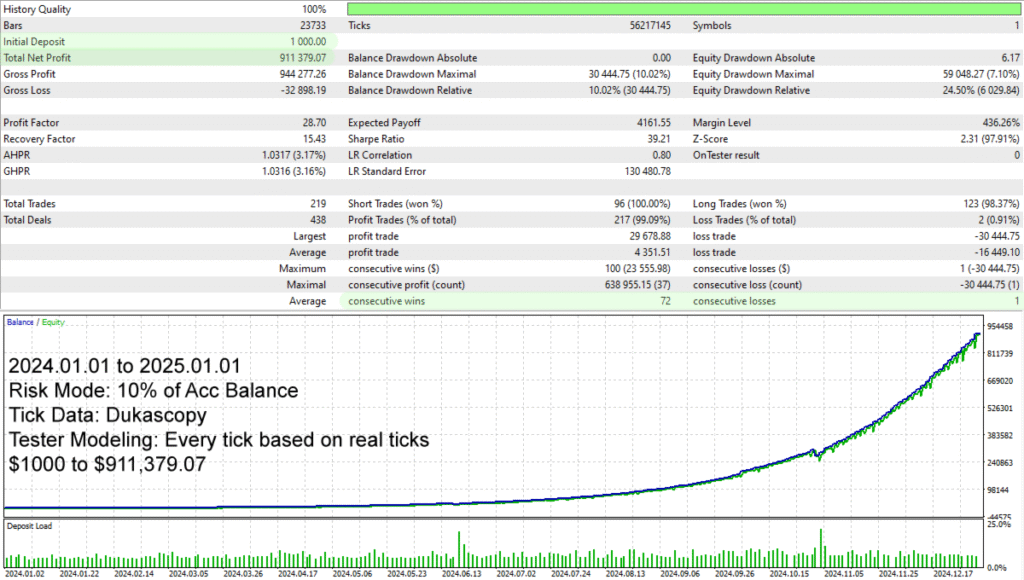

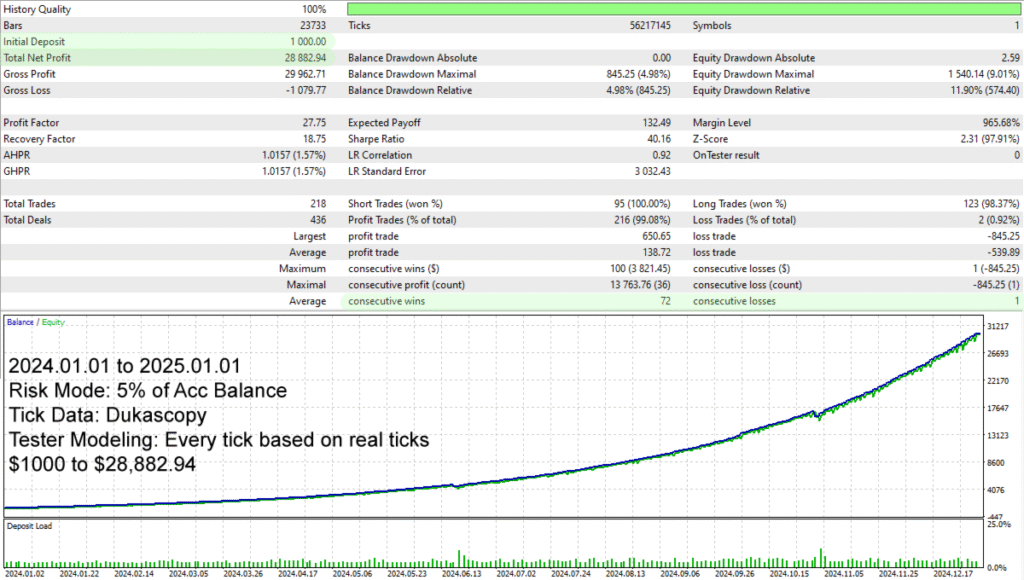

The Golden Algo forex robot makes some impressive performance claims:

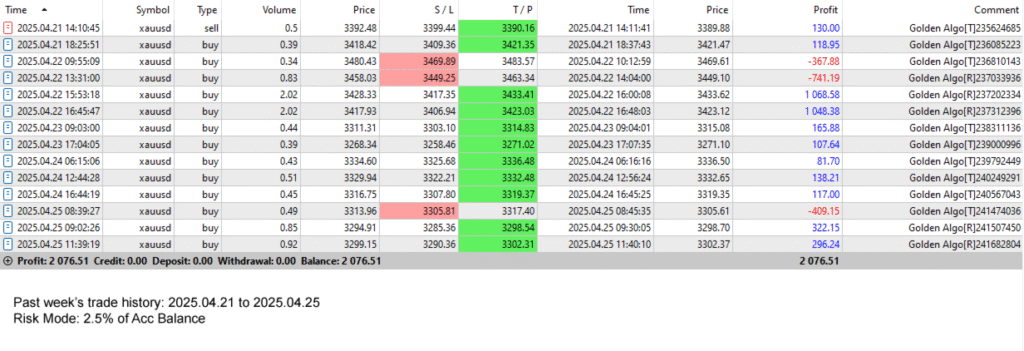

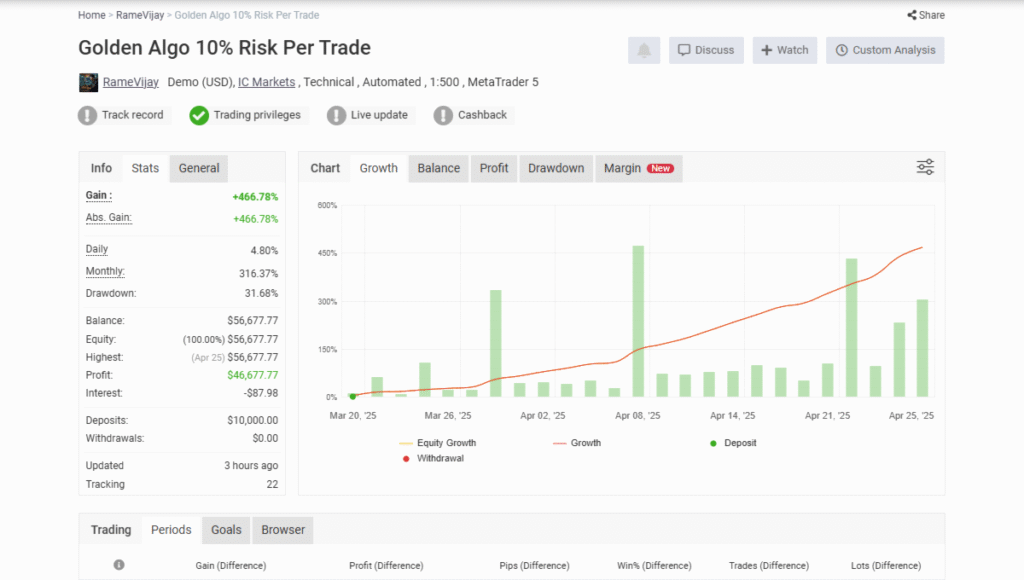

- +466.78% gain with 10% risk per trade (25 trading days)

- +62.60% gain with 2.5% risk per trade (25 trading days)

These numbers certainly grab attention, but they deserve some critical analysis. The higher percentage is achieved with extremely aggressive risk parameters (10% per trade) that most professional traders would consider excessive. The more conservative 2.5% risk setting produces more realistic results, though still impressive if sustainable.

Golden Algo EA Transparency Concerns and Explanations

One potential red flag is that the developers showcase demo account results rather than live trading performance. They explain this is due to US regulatory restrictions limiting leverage on live accounts. While this explanation makes sense, potential buyers should understand that demo results don’t always translate perfectly to live market conditions.

The developers address this concern by claiming that all signal account trades can be verified against backtests, with matching entry/exit times, prices, and trade comments.

Setup Requirements and Recommendations

If you’re considering this forex robot, here are the recommended specifications:

- Trading pair: XAUUSD/GOLD

- Timeframe: Any (flexible)

- Minimum deposit: $300 or higher

- Recommended leverage: 1:100 or higher

- Broker requirements: Not broker-specific, but low spread/commission brokers preferred

- VPS: Recommended for 24/7 operation

Is This Forex Robot Right for You?

The Golden Algo EA seems best suited for:

- Gold-focused traders looking to automate their XAUUSD strategy

- Mid-term traders comfortable with moderate trade frequency

- Risk-aware investors who understand the importance of proper position sizing

- Traders seeking AI integration in their automated systems

It may not be ideal for those seeking:

- Ultra-high frequency trading

- Multi-pair trading solutions

- Fully hands-off trading with no monitoring

Common Questions About Golden Algo EA

How accurate are the backtests compared to real performance?

The developers acknowledge that their signal account is relatively new, making definitive win-rate comparisons premature. They emphasize that every backtest trade matches the signal account trades on a one-to-one basis.

Does it use dangerous trading strategies?

According to the developers, the core strategy avoids risky practices like martingale, grid trading, or excessive averaging. However, the optional recovery mode does incorporate some risk multiplication that cautious traders might want to disable.

Why does it need external data connections?

The EA integrates external data sources including US Index movements, market sentiment metrics, and the OpenAI API. Users must connect to the developer’s website (‘www.goalai.live’) to access these data streams.

Pricing and Value Consideration

Currently priced at $499, with an announced upcoming increase to $799, the Golden Algo EA represents a significant investment. The developers use a tiered pricing model where costs increase based on copies sold – a common practice among EA developers looking to limit user numbers.

Final Thoughts: Potential With Proper Expectations

Like any forex robot, the Golden Algo EA should be approached with realistic expectations. The specialized focus on gold trading, combined with AI signal filtration, presents an interesting value proposition for XAUUSD traders.

However, I’d recommend:

- Starting with minimal risk until you’ve verified performance on your specific setup

- Testing thoroughly on a demo account before committing real capital

- Understanding the recovery mode implications if you choose to enable it

- Monitoring performance regularly rather than expecting a “set and forget” solution

Remember that even the best forex robots require proper risk management and occasional oversight. Market conditions change, and no algorithm – regardless of sophistication – can guarantee consistent profits across all market environments.

Have you tried any specialized forex robots for gold trading? I’d love to hear about your experiences in the comments!

Disclaimer: Trading involves risk. Past performance of any trading system or methodology is not necessarily indicative of future results. The information provided is for educational purposes only and should not be considered as financial advice.

Results

1.

2.

3.

4.

5.

6.

7.